FFL Storage Requirements [GUIDE]: How long do FFLs keep 4473?

Getting a Federal Firearms License (FFL) comes with great benefits like being able to have a business making and/or buying and selling firearms, buying firearms at dealer pricing, and even accessing firearms you couldn’t otherwise legally possess.

However, it also brings important responsibilities, particularly in record-keeping. Proper records help prevent criminal misuse of firearms and keep you, the FFL holder, in compliance with ATF regulations.

In this guide, we’ll focus on a crucial question: “How long must an FFL keep 4473 records?”

FFL Records: The Basics

The heart of an FFL’s records is the Acquisition and Disposition Book (A&D Book or “Bound Book”). This log tracks:

- Acquisitions: Firearms received or made by the FFL

- Dispositions: Firearms transferred, sold, or destroyed

The A&D book is crucial because it shows your current inventory and the history of firearms that have passed through your business. It’s the core record that demonstrates which guns are in inventory, which guns used to be in inventory, and where each of those previously possessed firearms went.

Form 4473

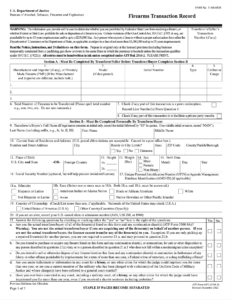

When a firearm goes to a non-FFL customer as a purchase or in other situations like the return of a consignment firearm, you must complete ATF Form 4473 (Over the Counter Firearm Transaction Record). This form is where most violations occur during ATF inspections, so accuracy is vital.

Key points about Form 4473:

- Both the customer and FFL must carefully complete it

- Even typos can result in ATF violations

- Customers who lie on this form face serious legal consequences (fines, jail, losing gun rights)

The Form 4473 must be kept in a prescribed method and for a determined duration for ATF inspection.

How Long do FFLs Keep 4473?

The retention requirements for Form 4473 have recently changed:

- Old requirement: 20 years for completed transactions, 5 years for voided transactions

- New requirement (as of 2022): FFLs must keep 4473s for as long as they are in business and licensed

This change came with ATF Rule 2021R-05F, which amended the record retention requirements in ATF regulations. To manage the increased storage burden, FFLs can now store records over 20 years old off-site in a warehouse.

4473 Storage Methods

FFLs must store 4473s in one of two ways:

- Chronological order by date

- By an internal Transferor’s Transaction Serial Number (TTSN)

If using a TTSN, you can record just the customer’s name and TTSN in the bound book. For chronological storage, you must include the customer’s full address in the bound book.

Up until recently, paper 4473s were really the only option. Even if they were filled out electronically, they had to be printed out, signed, and kept in boxes or file folders.

Electronic 4473 Storage

Good news! The ATF now allows electronic 4473 storage without special permission, as long as your system meets certain requirements. This can significantly simplify your record-keeping process.

Using FFL software like FFL Safe can help ensure you’re meeting all ATF requirements while making your record-keeping more efficient and accurate. Electronic storage offers several advantages:

- Easy search and retrieval of records

- Automatic backups to prevent data loss

- Compliance checks to catch errors before they become violations

- Space-saving compared to paper storage

Remember, proper record-keeping is crucial for your FFL compliance. By understanding these requirements and using the right tools, you can ensure your business stays on the right side of ATF regulations while minimizing the administrative burden.

This is why using the Best FFL Software is really important.

Easy FFL 4473 Management System

Another thing to consider is the FFL software you use. Some FFL software includes electronic 4473 and thus give you an easy way to store the 4473 with automatic connection to the respective A&D entry.

However, that isn’t always the case, and most FFL software is expensive.

This is no longer the case though, because FFL Safe is an absolutely free FFL A&D bound book with electronic 4473.

You’ll find that with FFL Safe, it is:

- User-friendly interface: No more struggling with complex spreadsheets or paper logs.

- Automatic compliance: The app helps you to follow ATF regulations.

- Time-saving: Spend less time on paperwork and more time running your business.

- Secure: Your records are safely stored and backed up.

I highly recommend giving FFL Safe a try. It’s free, and it’ll make your life as an FFL holder much easier. You can sign up for free here.

FAQ

Recent Posts

February 21, 2026

February 21, 2026

February 21, 2026

February 20, 2026